are hoa fees tax deductible in florida

Year-round residency in your property means HOA fees are not deductible. Nine states Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming have no income taxes.

The All You Need Checklist Bundle For Homeowners Association Management 8 Free Hoa Checklists Process Street Checklist Workflow And Sop Software

Are HOA fees optional.

. A few common circumstances are listed below. June 5 2019 602 PM. If you are a W-2 employee.

Every homeowners association HOA is different but there are several situations in which you can deduct some or all of your HOA fees. However there are special cases as you now know. As a general rule no fees are not tax-deductible.

The answer regarding whether or not your HOA fees are tax deductible varies depending on the situation. Are HOA-fees deductible. During the rental season you can claim a deduction for the expenses of the condominium unit as well as for rent.

If you have purchased a home or condo you are likely paying a monthly fee to cover repairs and maintenance on the outside of your home or in common areas. A homeowners association runs a community by imposing certain rules preserving its aesthetics and maintaining various aspects of the neighborhood. Those who live within an HOA community though often wonder Are HOA dues tax deductible The short answer is no.

You can reach HOA fees tax deductible status if you rent out your property either year. Though many costs of owning a home are deductible on your income taxes including your mortgage interest and property taxes the IRS does not allow you to deduct HOA fees because they are considered an. Yes HOA fees are deductible for home offices.

If you are a land developer then it is deductible as a. The debt portion can be paid off in full which reduces your taxes. Before claiming your HOA fees you will have to determine how much space your home office takes up in your house.

Ad From Simple To Complex Taxes Filing With TurboTax Is Easy. Can I deduct HOA fees for investment property -- raw land. However if the home is a rental property HOA fees do become.

How you use the property determines whether the HOA fee is tax-deductible or not. A Homeowners Association HOA is a governing body that sets specific rules and guidelines that you agree to abide by when you purchase property in a condominium gated community apartment or other type of planned development. There are many costs with homeownership that are tax-deductible such as your mortgage interest and property taxes however the IRS will not permit you to deduct HOA fees they are considered a charge by a private individual.

First though lets take a look at what an HOA is what they offer and what that can mean for you come April 15. Though many costs of owning a timeshare are deductible on your income taxes including your mortgage interest and property taxes the IRS does not allow you to deduct HOA fees because they are considered an assessment by a private entity. Both fees are passed through the owners taxes.

Hoa fees range may vary depending on the location of your property and the facilities available to. Can you negotiate CDD fees. February 23 2020 456 PM.

1 Best answer. However if you have an office in your home that you use in connection with a trade or business then you may be able to deduct a portion of the HOA fees that relate to that office. Well go over whether or not an HOA fee is tax deductible and if so under what circumstances.

If you purchase property as your primary residence and you are required to pay monthly quarterly or yearly HOA fees you cannot deduct the HOA fees from your taxes. Are HOA fees tax deductible in Florida. Are HOA fees tax deductible in Florida.

Once you figure out the percentage youll use that number to deduct your HOA fees. These fees are used to fund the associations maintenance and operations. No Tax Knowledge Needed.

Please see a tax specialist for professional tax recommendations regarding your particular situation. Are Condo Fees Tax Deductible In Ontario. Unfortunately homeowners association HOA fees paid on your personal residence are not deductible.

One of the questions you are probably asking yourself is Are my HOA fees tax deductible. TurboTax Makes It Easy To Get Your Taxes Done Right. The short answer is YES a percentage of your monthly maintenance is tax deductible and this percentage is different from unit to unit depending on number of shares owned.

Yes if you work from home then you can write off certain expenses related to your home office which includes HOA fees. HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas. Are homeowners association fees tax deductible.

But there are some exceptions. As a homeowner it is part of your responsibility to know when your HOA fees are tax-deductible and when they are not. HOA fees are typically not 100 percent deductible but you may still be able to claim some portion of them as a writeoff.

However this only applies if you are self-employed and choose to work from home. If you live in your property year-round then the HOA fees are not deductible. Are hoa fees tax deductible.

For the most part no but there are exceptions. Filing your taxes can be financially stressful. Those condominium fees are what your common property is being maintained repaired maintained and even paid for on a daily basis.

You can also deduct 10 of your hoa fees. They also receive amenities and upkeep of certain areas and they pay for only a fraction of the infrastructure costs via their homeowners dues which are often. Are hoa fees tax deductible in florida.

If the land is rented out as pasture for example the the HOA fees are a deductible as a Rental expense then. If the timeshare is a rental property however HOA fees do become deductible. Generally HOA dues are not tax deductible if you use your property as a home year-round.

Is it true that Florida has no income tax. If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities. It is deductible but where is determined by how the land is being currently used.

You may be wondering whether this fee is tax deductible. It does this with the help of HOA dues fees that the association collects from members.

Allowable Deductions For Capital Gains The Friendly Accountants

Are Hoa Fees Tax Deductible Clark Simson Miller

Are Legal Expenses Tax Deductible For Your Business Boyer Law Blog

Florida Villa Rental Taxes Tuscan Ridge

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Can I Write Off Hoa Fees On My Taxes

Are Hoa Fees Tax Deductible Here S What You Need To Know

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Are Homeowners Association Fees Tax Deductible

Are Hoa Fees Tax Deductible Clark Simson Miller

Everything About Hoa Fees You Need To Know The Best Guide

Is Buying Into An Hoa A Big Mistake

10 Easy Home Based Small Business Tax Deductions Learnaboutus Com

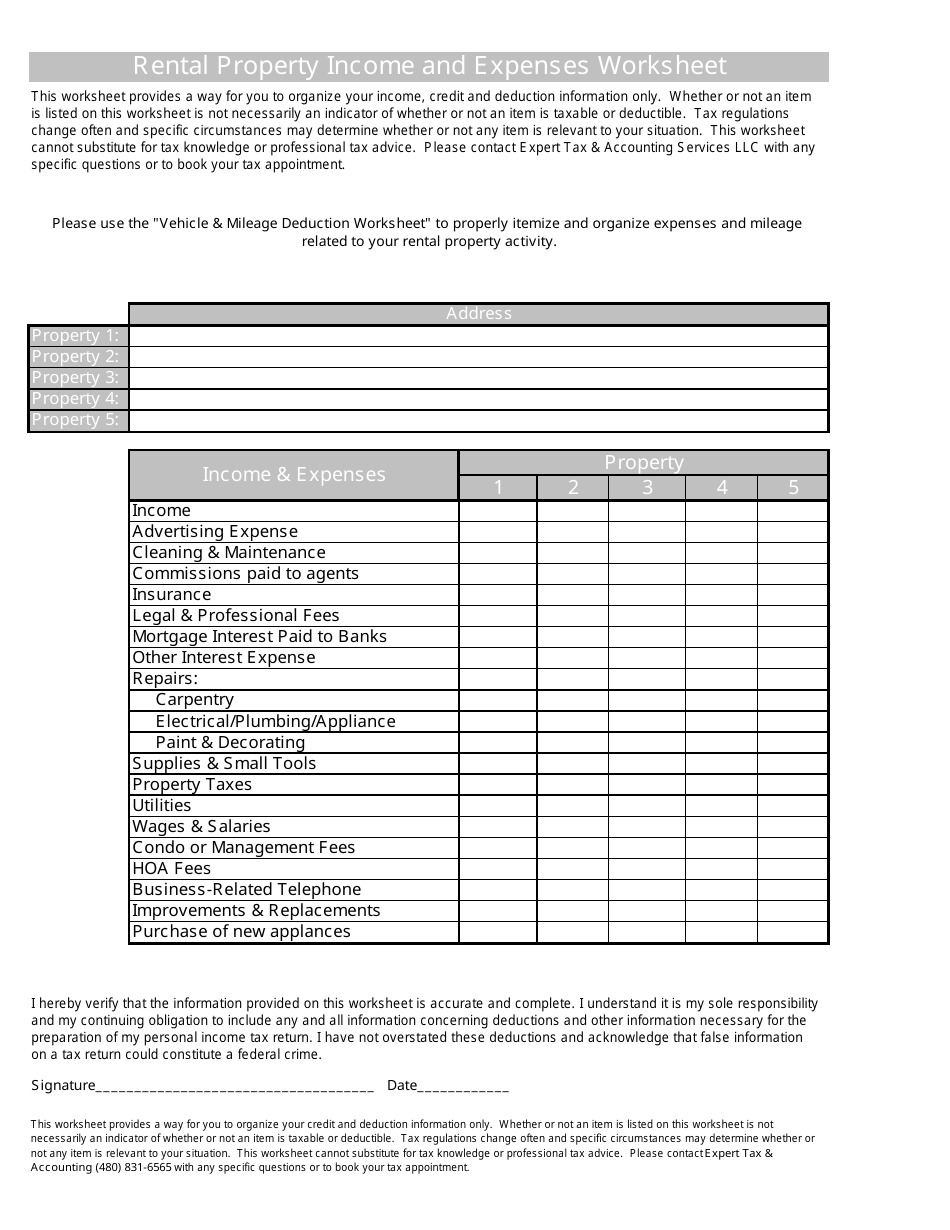

Rental Property Income And Expenses Worksheet Expert Tax Accounting Services Llc Download Printable Pdf Templateroller

Are Hoa Fees Tax Deductible Clark Simson Miller