child tax credit 2021 amount

New 2021 Child Tax Credit and advance payment details. 9000 3.

Child Tax Credit 2021 Here S Who Will Get Up To 1 800 Per Child Nj Com

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

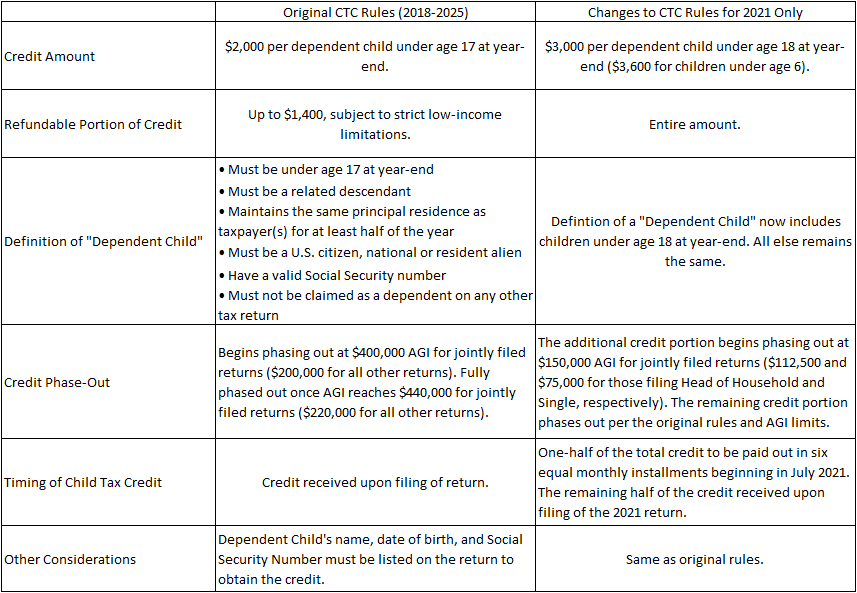

. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600. A childs age determines the amount. The amount of your Child Tax Credit will not be reduced if your 2021.

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. For 2021 eligible parents or guardians. The maximum annual Child Tax Credit rates are shown below.

You can file a 2021 tax. Get more information on the Recovery Rebate Credit. These people are eligible for the.

The credit amounts will increase for many. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The American Rescue Plan which was approved in 2021 expanded the usual child tax credit from 2000 per child to 3600 per child under age 6 and 3000 per child ages 6.

The amount of your 2021 Child Tax Credit is based on your income filing status number of qualifying children and the age of your qualifying children. 1400 per qualifying adult or child dependent. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The IRS pre-paid half the total credit amount in monthly payments from. Up to 3600 for each qualifying child ages 5 and under. 9000 59600.

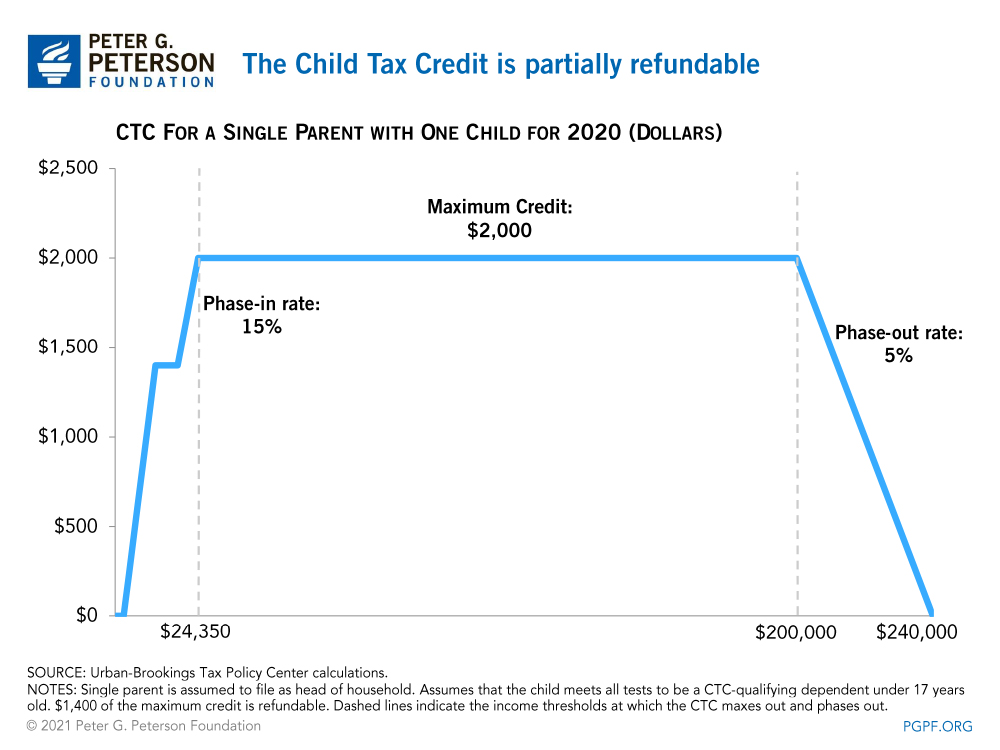

The news follows an audit released in September by the Treasury Inspector General for the Tax Administration that found that 11 billion in Child Tax Credits were sent to 15 million. The amount changes to 3000 total for each child ages six through 17 or 250 per. The first phaseout reduces the Child Tax Credit by 50 for each 1000 or fraction thereof by which the taxpayers modified AGI exceeds the income amounts above.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600. This year more workers without dependent children can claim the credit and can receive up to three times more money than in 2020. If you havent filed a tax return before or dont file every year and are eligible for the Child and Dependent Care Credit be sure to file to receive the credit this year.

July August September and October with the next due in just under a week. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. What is the maximum amount of his child tax credit for 2021 assuming he is under the AGI threshold.

Your amount changes based on the age of your. Child Tax Credit family element. Have been a US.

The tax credits maximum amount is 3000 per child and 3600. Yes if your 2021 income is high enough the amount of Child Tax Credit you can claim will be reduced. The new 2021 US.

6000 2. Families can claim the expanded Child Tax Credit even if they received monthly payments during the last half of 2021. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

12600. Child Tax Credit amounts will be different for each family. The total credit is as much as 3600 per child.

That comes out to 300 per month through the end of 2021 and 1800 at tax time next year. Before the American Rescue Plan people with no. Rates per year 2022 to 2023.

2021 Advanced Child Tax Credit What It Means For Your Family

What Is The Child Tax Credit Tax Policy Center

Child Tax Credit 2021 What S Changed Multop Financial

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Changes Weigh The Benefits Vs Impact On Your Tax Liability Grf Cpas Advisors

Now Is The Time For An American Child Benefit People S Policy Project

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

Here S What You Need To Know During Tax Season If You Received Monthly Child Tax Credit Payments In 2021

Child Tax Credit 2021 A Quick Guide Clearone Advantage

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How The New Expanded Federal Child Tax Credit Will Work

The Child Tax Credit Grows Up To Lift Millions Of Children Out Of Poverty Tax Policy Center

Here S What You Need To Know About The Monthly Child Tax Credit Payments New Hampshire Bulletin

Will You Have To Repay The Advanced Child Tax Credit Payments